Built for NRIs/OCIs who

believe in India's growth story

SBNRI is an NRI/OCI only financial institution that facilitates NRI investments into India

SBNRI is an NRI/OCI only financial institution that facilitates NRI investments into India

.gif)

Banks, AMCs, NBFCs built in India were always Financial products first and not NRIs' first, we think the way an NRI first Financial Institution is to be built should be completely different, we welcome you to experience it yourself

Founder and CEO, SBNRI

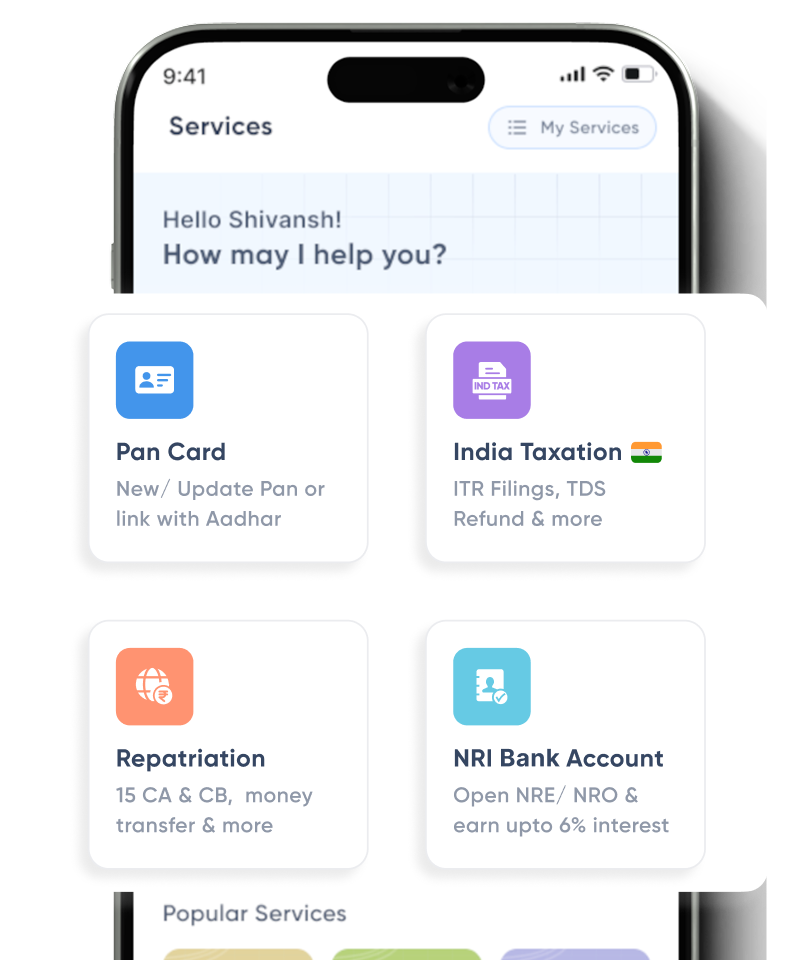

Trusted & certified platform to start your investments in India. Utilize your existing NRE/NRO funds to earn more or open a new NRI account with us.

SIMPLIFIEDKYC

7+ INVESTMENTASSETS

TAXATION &REPATRIATION

SBNRI is a certified Mutual Fund distributor registered with Association of Mutual Funds in India (AMFI) with Reg. No. 246671

Diversify effortlessly across multiple asset classes, all in one app.

Our experts simplify repatriation, TDS refunds, and NRI taxation so you can focus on growing your wealth.

_1_(2).gif)

Get expert insights and exit under performing funds to earn higher returns.

Making your NRI to resident investment transition smooth and straightforward.

SBNRI's compliant investment and taxation solutions designed specifically for RI transitioning to NRI.

Discover the benefits of investing through Gift City with foreign currency-denominated opportunities, including FDs, public equity, and private equity.

Download SBNRI arrow_outward

Download SBNRI arrow_outward

verified_user RBI registered banks

verified_user Robust Netbanking

verified_user Earn attractive interest rate*

Browse the largest collection of videos and blogs on India centric financial and tax queries